February 17, 2023: Global News Roundup

Global energy crisis grinds on—geopolitics, natural gas markets, and the Nord Stream pipelines

The Global News Roundup collects news stories from entirely international (non-US) media sources on variety of pressing global issues and events.

Good Morning, I’m picking up right where I left off last week with Seymour Hersh’s report about the bombing of the Nord Stream pipelines. To quickly sum up, the article Hersh published last week on Substack summarized his investigation and provided evidence that the US and Norway worked together to covertly sabotage the Nord Stream natural gas pipelines running between Russia and Germany (the explosion occurred in September 2022). According to Hersh, US officials began planning the attack in secret in December 2021, two months before Russia invaded Ukraine. It’s hard to overstate how critically important these revelations are in thinking about the Ukraine war, the international balance of power, and the global energy economy. Among other implications, the report speaks to the notion that the war in Ukraine is about energy (and other resources) and Great Power politics, rather than some righteous mission to help the Ukrainian people defend themselves from Russian predation (see, e.g., here and here for NATO statements to this effect). World news over the past few weeks about natural gas trading and the global energy crisis shed light on the broader political-economic context within which the Nord Stream saga is unfolding.

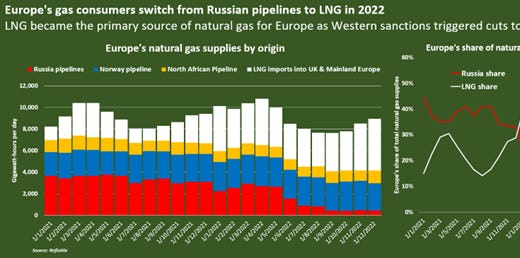

Starting in Europe, where Hersh’s report on the pipeline sabotage is only just starting to attract public attention, the International Energy Agency (IEA) on Wednesday released a “background note” on European gas supplies. The report begins by acknowledging the crisis that erupted late last February when Russia invaded Ukraine, which dramatically reduced European gas imports from Russia. The IEA cites 3 factors that allowed the EU to manage tighter gas supplies and higher prices over the past year: “The strong storage build-up was supported by a combination of well-tailored policy measures, a record inflow of LNG and a steep drop in natural gas consumption, in particular in gas-intensive and energy-intensive industries.” In other words, the EU spent about 800 billion euros mitigating the impact of rising prices on households and businesses, replaced lost natural gas from Russia with pipeline gas and liquified natural gas (LNG) from elsewhere (including—surprise!—from the US and Norway), and also de-industrialized to reduce domestic energy consumption. The graphs from Reuters below show how imported LNG replaced natural gas from Russia over the course of the war.

(Image: Europe’s gas consumers switch from Russian pipelines to LNG in 2022. Courtesy of Gavin Maguire writing for Reuters this past December, here.)

Norway exported record amounts of pipeline gas to Germany and other European nations in 2022: “The war in Ukraine has led to an increase in the demand for stable and reliable deliveries of natural gas, and the production of Norwegian gas is vital for meeting Europe's energy needs," Gassco CEO Frode Leversund said in a statement.” (Gassco is a Norwegian pipeline operator.) MercoPress reported recently that the Norwegian government’s hydrocarbon tax revenues tripled in 2022 over the prior year. Reuters reported in December that “U.S. LNG exporters boosted shipments to Europe by more than 137% in the first 11 months of 2022 from the same period in 2021… supplying more than half of Europe's imported LNG and helping the region weather a more than 54% plunge in piped shipments from Russia.”

While the IEA was optimistic about Europe’s energy situation in the short-term (partly owing to a warmer than expected winter), the organization warned that “this improved outlook should not be a distraction”, citing geopolitics and China’s economic recovery as major external risks: “Global gas supply is set to remain tight in 2023 and the global balance is subject to an unusually wide range of uncertainties and exogenous risk factors. This includes the possibility of complete cessation of Russian piped gas deliveries to the European Union, as well as a recovery of China’s LNG imports in line with the country’s long-term LNG contracts and a potential lower availability of LNG supply.”

They have good reason to be concerned about geopolitical risk in natural gas markets, particularly given that Russia is claiming that the US and UK have violated all of its “red lines”, has seriously ramped up attacks on Ukraine in recent weeks (and is gaining ground), and this week seemed to be considering a retaliatory response to the Nord Stream sabotage pending further investigation. If the war escalates further, or, if instead Russia succeeds, natural gas market disruption is probable. (Interesting facts: Ukraine itself has substantial proven oil reserves and also hosts portions of the Druzhba pipeline network that carries Russian gas to Slovakia, Hungary, and the Czech Republic. Ukraine is also one of only seven countries in the world that produces titanium sponge, required to manufacture the titanium plates used to produce military equipment and other technologies. Russia and China are also major producers, as is South Africa.)

In related news, US natural gas prices were rising again this week after the US’s Freeport LNG export terminal (located in Texas) came back online and resumed exports to Europe and elsewhere. “The resumption of nat-gas exports from Freeport will curb U.S. gas inventory builds and is bullish for prices,” reported the Global and Mail on Tuesday. (Our gas bills are through the roof here in Denver, owing to high prices and a cold winter. See this article in our free local paper for a sense of how Coloradans are managing.) In spite of much discussed recent declines, global energy prices overall remain about 125% higher today than they were in 2016.

Meanwhile, Europe has been wracked by protests over the past year—in the UK, Germany, and France, among others—as residents and small business owners struggled with inflated energy costs. The Economist noted last fall that it is Europe’s smallest businesses that are struggling most as energy costs bite, though larger firms involved in energy-intensive production (e.g. chemical manufacturing) are also experiencing serious difficulties. And already there is a lot of talk about how next winter’s energy situation is going to be even worse, especially in the UK (see here and here, for example). European economies have been wrestling since last year with growing trade deficits associated with rising energy import costs alongside reduced manufacturing surpluses as deindustrialization proceeds: “Europe, the world’s largest economic bloc, enjoyed stable trade surpluses for a decade but the war in Ukraine and the ensuing energy crisis have tipped the Continent into a spiraling external deficit unseen since the launch of the euro.” As the trade deficit (and also public debts) continue to grow, it is unclear for how long Europe will be able to sustain the massive spending that has helped ordinary people stay afloat. Over the past year since the Ukraine war started, Germany allocated almost 10% of GDP to “shield households and firms from the energy crisis”; Slovakia allocated over 9% of GDP, Italy close to 5%, the UK almost 4%. This level of spending is unsustainable over the medium-term, especially as interest rates continue to rise.

But, as the IEA’s background note made clear, Europe’s energy predicament is not a problem just for Europe. Europe’s new hunger for imported LNG is undermining living standards in other countries, many of them low-income nations struggling to manage a vicious cascade of crises: “The strong price signals provided by the European hubs led to a reconfiguration of global LNG flows towards the European Union, primarily spot and destination-flexible LNG from more price sensitive markets. Lower LNG deliveries deteriorated electricity supply security in South Asian markets – including in Bangladesh and Pakistan where load shedding schedules were introduced through 2022.” In other words, as LNG prices paid by European consumers rose last year, with European governments trying to stabilize prices and store natural gas reserves for winter, global supplies were diverted from poorer countries into these wealthier European markets. The Times of India explained this week how Pakistan, which has been devastated by natural and economic disasters over the past year, has been impacted: “The country’s reliance on energy imports coupled with a financial crisis made it especially vulnerable to shortages exacerbated by Russia’s war in Ukraine. Unable to afford soaring LNG cargoes, it has suffered frequent electricity blackouts and has had to ration fuel.”

Along similar lines, a recent study covered on Thursday by ABC News (the Australian Broadcasting Corporation) found that, “Up to 140 million extra people could be tipped into extreme poverty worldwide by an energy crisis that has sent prices soaring more than 100 per cent for many households”. The article continued on to note that while energy costs had driven an average 4.8% increase in household spending, the rate of increase in “poorer countries” was much higher in part owing to indirect energy costs (i.e., rising costs of other goods that use energy as a production input):

To illustrate the point, the report cited Rwanda in East Africa, where almost the entire population used biomass — and not fossil fuels — to provide energy for things such as cooking. Despite this, the report noted the overall burden being shouldered by people in Rwanda was one of the highest in the world. It said this was because people in the country were particularly exposed to the costs from the crisis indirectly flowing through to the other goods they needed to buy such as food and clothes.

More than 50% of the population of Rwanda lives in poverty, according to 2016 data from the World Bank, and GDP/capita is about US$820 per year.

In other news, Al Jazeera has been thoroughly covering the earthquakes in Turkey and Syria, the rescue efforts, and how people in the region are coping and surviving and helping one another. If you’re interested, this story is about how local families are opening their homes to earthquake survivors, and this story is about the dog-human teams from all over the world travelling to Turkey and Syria to locate survivors in the rubble. The images below depict some of the rescue teams. “This is not your pet that you toss the toy for in the back yard a couple of times and they kind of get tired and lay down. These dogs will go until they drop, until you tell them it’s time to stop,” said Denise Sanders, director of communications and search team operations, about the dogs.

(Image: A human and K9 rescuer search a destroyed building in Antakya, Turkey, on February 10, 2023 [Hussein Malla/AP Photo], from Al Jazeera, here.)

(Image: South Korean rescue workers and dogs prepare to leave for Turkey, on February 7, 2023 [Yonhap via Reuters], from Al Jazeera, here.)

Things I’m keeping an eye on:

1. Oil markets: OPEC is bullish on oil into 2023, forecasting increased demand from China. The IEA’s February oil market report was somewhat unclear, with a lot depending on sanctions, OPEC decisions, and other political factors. The US released 26 million barrels from its Strategic Petroleum Reserve on Monday.

2. South Africa’s joint military drills with China and Russia: “On Monday, the Russian military frigate "Admiral Gorshkov" docked in Cape Town harbor ahead of naval exercises hosted by South Africa between the 17 and 27 of February. It is the second such operation involving the naval forces of Russia, South Africa and China, and the first since 2019.” The Admiral Gorshkov is hypersonic-missile capable and was deployed by Russia to the Indian Ocean last month, apparently as a warning to the US and its allies.

3. Ukraine: Russia is advancing in the east. Ukraine is asking for more support from NATO countries, including fighter jets. Since the Nord Stream news broke, though, the US has back-stepped a bit in its support for Ukraine, including warning Ukraine on Thursday against attacking Crimea (occupied and claimed by Russia since 2014).

4. South China Sea: The US and the Philippines reported an incident with China in the South China Sea this week. The Philippines accused China of using lasers to temporarily blind the crew of a Philippine coast guard vessel traversing disputed waters in the region, calling it a “provacative act”. The US is publicly supporting the Philippines.